Money, banking & insurance

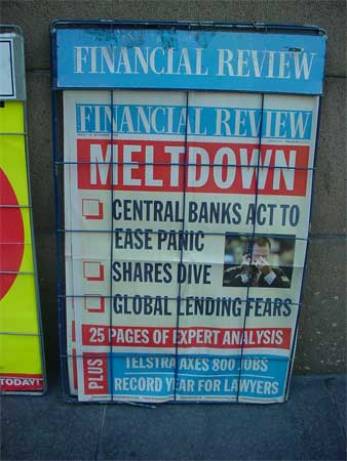

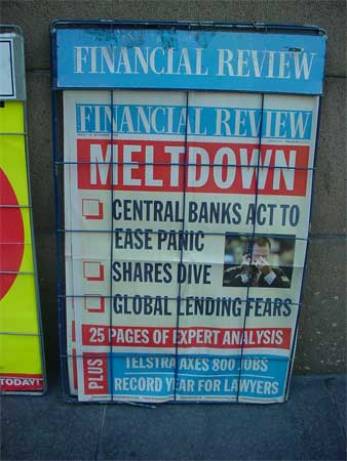

A newspaper, a pint of milk and a home loan please

Newsagents in Australia are about to start selling home loans as a reaction to increased competition from the likes of supermarkets that are selling newspapers and other impulse items. The plan is for approximately1,200 newsagents to receive commissions for successful introductions to a lender called Homestar Finance. However, the newsagents will only be a marketing arm and will not in effect become mortgage brokers. Some newsagents are already distribution channels for Bill Express and Western Union so to some extent the idea is a logical extension. In a similar vein 7-Eleven in the US offers 24 hour bill payment services through its Vcom kiosks and Australia Post is allegedly looking at extending bill payment services into areas like loans.

Ref: The Australian (AUS), 15 March 2005, 'Read all about it: newsagents to deliver loans. www.theaustralian.com.au See also: the Australian Financial Review. www.afr.com.au Links: Indian restaurants in the UK offering loans.

Lose weight and save pounds

Three insurance companies in the US, UK and South Africa have a novel approach to saving money. The idea is that the healthier you are the smaller your insurance premiums get. PruHeath in the UK offers 'vitality points' for customers who join a gym, give up cigarettes, improve their body-fat index or read books about keeping fit. And as we all know points mean prizes - which in this case means cheaper health insurance. Discovery Health in South Africa (the originator of the idea) and Destiny Heath in the US offer similar 'cash for health' policies. Given that car insurance companies have offered discounts for safer drivers for many years it's surprising that nobody has thought of this before. What's next? - governments offering cash payments to stop people smoking or for children to eat more fruit?

Ref: The Times (UK) 9 October 2005. 'Cash in on keeping fit', S.Compton. www.timesonline.co.uk

Your flexible friend

What can you do to a credit (or debit) card to make it more interesting and create some differentiation? One idea, which apparently seems to work, is to shave the corner off a standard card to give it a nice round feel (Virgin Money). Another idea is to make the card terribly tiny in a iPod Mini kind of way (National Australia Bank). The idea behind the latter is that you receive two cards, one full sized that works in ATMs and one mini sized that you can use in 'swipe' terminals. You can choose what colour you want your cards (red, silver, blue, pink or lime) and you even get some accessories to use with your card (like a neck chord and a phone attachment). Nice, but not as nice as the 'create' card from Lloyds TSB (UK) that allows you to go online and adjust your card settings.

Ref: Sydney Morning Herald (AUS) 23 February 2005, 'Less is more', M.Innis. www.shm.com.au Also see www.createcardoffer.com

Trends and uncertainties for 2005

According to Morgan Stanley there is a 50% probability of any of the following happening in 2005:

- Crude oil rises to $60 a barrel

- The US dollar which falls to 1.50 Euro and 85 yen

- The yield on 10 year T-Bonds rises to 6.0%. China and Japan reduce their buying

- The US equity market goes flat

- China rejects any change to its currency system and remains pegged to the US dollar

- Japan is stuck as a high cost producer in a low cost region and slips into recession

- There is a second Russian Revolution and the Russian market drops 25%

- There is resurgence in coal as recoil against oil prices

- The summer is either too hot, too cold, too wet or too dry - food prices rise sharply

- The US congress puts a limit on plaintiffs' lawsuit damages.

Over on the other side of the Atlantic the UK Building Societies Association recently made 10 predictions for 2005. These included rising savings, falling borrowings, no reduction to FSA rules, growth of child trust funds and depolarisation of financial advice. The first two predictions (more saving and less borrowing) are potentially unsustainable for some institutions and many building societies like the Bradford and Bingley have already started to offer 130% mortgages to stimulate demand.

Ref: Morgan Stanley (US) advertisement (Looking down the road for 2005) The Asian Wall Street Journal, 25 January 2005. www.awsj.com Building Societies Association (UK) www.bsa.org Ten Predictions for 2005

ID theft versus ID cards

Identity theft is now a $56 billion problem in the US and is up 600% in the past 5 years in the UK. Back in 1999 there were just 20,000 reported cases of identity theft in the UK but in 2004 the figure had risen to 119,000, which cost Britain about GB £1.3 billion. According to a survey by Which magazine 25% of Britons have had their ID stolen or know someone who has. Back in the US, Internet identity fraud is causing banks and other companies to consider adding an extra layer of security to the sign-in process. Leading contenders include small hand-held authentication devices that attach to a key chain and display a new six-digit number every 60 seconds. AOL Passcode is one such a device and banks like ABN Amro and Rabobank in Europe already issue similar security devices. And if you are unfortunate enough to have your identity stolen there are a number of companies that can help you get it back. These include identitytheft911.com (Citibank) and ID theft insurance (progeny/AIG). Of course one solution might be a national identity card scheme using biometrics. As you'd expect governments are generally in favour of such moves but there is significant disquiet about such back-door control and surveillance.

Ref: Various including Money Observer (UK) 4 March 2005 www.moneyobserver.com, Weekly Telegraph (UK) issue #711 New York Times (US) 24 December 2005.

Contactless payment

AC Nielsen predicts that by the year 2020 only 10% of transactions in the US will be cash. The other 90% will be electronic payments of some form including credit cards, debit cards, e-cash and micro-payments using your mobile phone. One example of the shape of things to come is the fact that until recently McDonald's only accepted cash worldwide. Now the company accepts credit cards in the US and is testing ideas like the MasterCard PayPass system in some restaurants. Such e-payment schemes use the same technology that some motorists have in their cars to automatically pay road and bridge tolls without stopping. The benefits of such 'contactless' payment technologies to retailers like McDonald's include the fact that customers can buy things without getting out of their car. You don't need your wallet and you don't even need to get dressed. This is actually a significant attraction if it's 2am or you don't want the hassle of getting small kids in and out of the car - with them grabbing things you don't want to buy once they're inside the store. The obvious beneficiaries of contactless payment are drive-in operators like fast food companies and petrol (gas) stations but the technology could spawn a new generation of drive-through retail including video hire, libraries and convenience stores.

Ref: New York Times (US) 10 January 2005. 'Momentum is gaining for cellphones as credit cards'. www.nytimes.com See also: Card Technology magazine15 March 2005. www.cardtechnology.com

Is plastic money on the cards?

Last December debit card transactions grew by 24% in the US and electronic payments (including plastic credit and debit cards) surpassed cheque payments for the first time in history. Nevertheless, the US is not convinced by the benefits of plastic money - not plastic notes anyway. Plastic (technically polymer) notes were first developed in Australia in 1988 and are used in countries such as Australia, New Zealand and Romania. However, they have been slow to take off in other countries because of the costs associated with the new machinery. The benefits of plastic notes include the fact that they last much longer and are less likely to tear. They are also more difficult to counterfeit and healthier for people to carry around because the lower level of absorbency means they carry fewer germs. Nevertheless, don't expect to see the widespread adoption of polymer money anytime soon because the innovation is likely to be leapfrogged by digital money in the next 10-15 years.

Ref: The Economist (UK), 5 February 2005, 'A durable idea'. www.economist.com