Money, banking & insurance

Mobile money

It may sound strange, but Nairobi, Kenya is a forerunner in embracing mobile technology with 92% of Kenyans going online through a mobile phone. In fact the country has earned its own nickname, Silicon Savanna. At a recent conference for mobile phone software in Nairobi, participants heard how a phone can be a financial tool. Using a program called Elma, from Craft Silicon, a mobile phone can act like a credit card, an online bank, trade shares or currencies, organise a payroll, and compare prices online.

Kenya is showing us the future in mobile money. Yankee Group forecast the total value of mobile transactions worldwide will rise 700% from $US162 billion in 2010 to $US984 billion in 2014. Some of the players in this market are Google, Intuit’s GoPayment, PayPal and Square.

The US start-up, Square, launched in 2010 and allows businesses to accept credit card payments on their mobiles. Richard Branson recently became an investor. The company offers a free, easy to use card reader and mobile application and charges 2.75% per transaction. So far, it has processed over $US2 billion in payments and plans to go international in 2012. One of its innovations was to create software for iPads, called Register, which accepts payments while tracking customer buying habits. It eliminates the need for cash registers.

Danske Bank in Denmark allows customers to download an app for their Android, iPhone or iPad, which uses the built-in camera to take pictures of their bills. Instead of having to manually enter all the details, the phone uses the photograph and pays the bill.

Mobile money is already a feature in Africa and, for every 10 extra mobiles per 100 Africans, GDP rises 0.6% to 1.2%. Here in the West it may take a little more time to be accepted but there’s no question it will be transformative and cash registers will be a thing of the past. Cash may well disappear too.

Ref: Time Magazine (US), 30 June 2011, Silicon Savanna: Mobile phones transform Africa. A Perry. www.time.com/time

Springwise.com (Neth), 19 March 2011, Snap a photo of a bill, then click to pay. www.springwise.com

Wall Street Journal (US), 30 June 2011, Start-up rival of Paypal snags big value: $1 billion. M Langley. www.wsj.com

Source integrity: Various

Search words: mobile phone, Africa, farming, Craft Silicon, Nairobi, GDP, mobile banking, M Pesa, Google, Silicon Savanna, M-Farm.

Trend tags:

An identity program for India’s poor

Some Indians are very poor yet they cannot even access welfare benefits; others can’t open a bank account or get a drivers licence. The reason is they have no identity. This is why the Indian government is spending $US326 million next year on a ten-year project to create the world’s largest biometric identity database. Each citizen will have his irises and fingerprints scanned to receive a 12-digit ID number. The system, known as Aadhaar, will be able to verify the identity of any Indian within 8 seconds, using a handheld device and the mobile phone network.

Mr Nilekani, the ex-Infosys Chairman and billionaire behind this idea, says the program is as important as a road because it “in some sense connects every individual to the state”. It means that Indians can be citizens without having to be part of some caste, kin or religion. Fortunately, it also reduces opportunities for corruption.

Others fear the database will reduce the state’s role in helping the poor, or that the government will use the program to track citizens. However, the database records only name, date of birth, sex and address, and is limited to answering yes or no to any question. Officials at the highest levels in India seem to support the program.

Ref: The New York Times (US), 18 September 2011, In India, a digital program to benefit poor. L Polgreen. www.nyt.com

Source integrity: *****

Search words: biometric identity database, poor, welfare, banking, phone, poverty, technology, Aadhaar, citizenship, Bangalore, bureaucracy.

Trend tags:

�

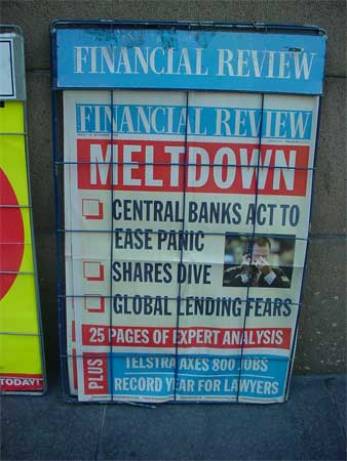

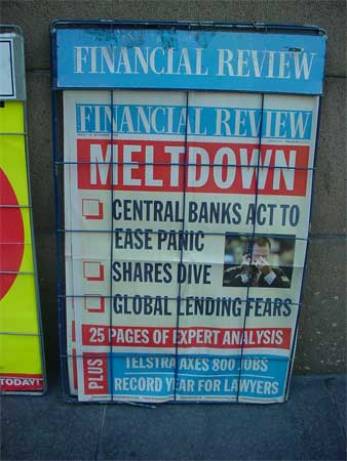

Why the Depression was better than this

The Great Depression in America may have been more of a blessing than a curse. The 1930s saw the manufacture of TV, nylon stockings, refrigerators, washing machines, and much improved roads and railways. They were the “most technologically progressive decade of the century”, according to the historian, Alexander J Field. The current financial crisis has no such examples of production, unless you include all the digital services offered by the internet. But as McKinsey wrote, the digital economy does not create anything tangible and it sheds jobs. (See: The biggest change since the industrial revolution.)

From an economic point of view, the Depression was a poor decade cyclically (short term), but one of the best secularly (long term). Today, America is in the grip of both cyclical and secular crisis, including the current financial one, combined with a long-term slowdown in company start-ups, and relatively poor progress in education. About 6.5 million people have had no job for at least six months and a few million have dropped out of the workforce.

America still has the following advantages: good venture capital network, rule of law, risk-taking culture, and appeal to immigrants. Yet the US is the only rich country in the past 30 years that has not increased the number of young adults with degrees. Three huge industries – housing, finance and healthcare – have unproductive capacity and, even though the US spends 50% more per head on medical care, its results are little better. See: Why the neediest patients get the worst care.

Volatility in the sharemarket only contributes to the sense of uncertainty about the US economy. No wonder some people look back with nostalgia at the Great Depression.

Ref: The New York Times (US), 16 October 2011, If only it were a depression. D Leonhardt. www.nyt.com

The New York Times (US), 18 September 2011, The new standard: Volatility. L Story and G Bowley. www.nyt.com

Source integrity: *****

Search words: the Great Depression, 1930s, economists, cyclical trend, secular trend, US, unemployment, financial crisis, venture capital, risk, immigrants, internet, education, finance, health care and housing, innovation, sharemarket.

Trend tags:

No rest for the unemployed

The London riots are a good example of how an economic downturn can fuel unrest in the people. Instability is often blamed on austerity and a recent paper from Barcelona suggests it’s true. From 1919-2009, there was a strong relationship between fiscal austerity and protests, strikes, assassinations and attempted revolutions. Researchers also found more people took part in protests against austerity, about 700,000, compared to protests about war, about 15,000.

Meanwhile, tax rises seem to have more effect on those on high incomes while service cuts are felt most by people on low incomes. Today’s widespread unemployment among young people and others is likely to trigger further social unrest. Much of it is caused by automation and there seems little likelihood that this will reverse. See: The biggest change since the industrial revolution.

Another bugbear is food prices, widely forecast to rise because of a burgeoning population, climate change, and reduced land for agriculture. An IMF study of 120 countries from 1970-2007 found a 10% hike in food prices doubled the number of anti-government protests in low income countries.

So what is the likelihood of further social unrest like, or worse than, the London riots? We expect unemployment to be the biggest cause of trouble in the next few years, as our system adjusts to the fact that it couldn’t give people jobs, even if it wanted to.

Ref: The Economist (UK), 22 October 2011, Unrest in peace. Anon. www.theeconomist.com

Source integrity: *****

Search words: instability, Occupy Wall Street, anger, austerity, spending cuts, demonstrations, protest, tax, unemployment, inequality, automation, food prices, unrest.

Trend tags:

Our dream house is falling down

In America, there are 1.6 million homes too many and the American dream of owning a house looks bitter indeed. Leuthold Group, a US investment firm, says every housing statistic today matches the pattern of prices after a bubble. This includes new and existing home prices, housing starts, and homebuilding shares. The firm expects the housing decline to take many years and have a large multiplier effect across the whole economy.

Standard & Poor’s 20-city index of prices has fallen to 2003 levels and in Last Vegas, to 1999 levels. While prices are more affordable, people are unable to get loans because of the tight rein on lending. It was undisciplined lending (and borrowing!) that created the housing bubble in the first place, and encouraged 5 million renters to become buyers. Now those people are being evicted back into the rental market. Some 6-7 million foreclosures may be yet to come, according to bond giant, Pimco.

Some 30% of people selling their homes are making a loss. American homeowners have an average 38% equity in their homes, half what it was in 1950 and a third less since 2005. The problem for many is they have negative equity in their homes. This is a problem prevalent in the UK as well as the US.

The ripple effect of a crushed housing market is sharp reduction in construction jobs, and falling demand for washers, dryers or carpets. The upside is that people will have more modest expectations about economic growth, living standards, and what they can afford. Perhaps.

Ref: Businessweek (US), 7 July 2011, The housing horror show is worse than you think. R Farzad. www.businessweek.com

Source integrity: ****

Search words: construction, housing, prices, buyers, asset bubble, foreclosure, America, affordability, loan, lending, renting, ‘illusory prosperity’.

Trend tags: