Money, banking & insurance

The Future of ATMs

Banks in India are looking at the possibility of embedding new services into ATM networks, according to an article in moneycontrol.com. NCR (a maker of ATMs) says that future products and services could include booking airline tickets, cinema tickets, printing bank passbooks and renewing driving licenses. Meanwhile, in Japan, biometric ATMs are taking off. For example, Sumitomo Mitsui Bank allows customers to withdraw the equivalent of several tens of thousands of dollars from biometric ATMs fitted out with vein scanners. The ‘super ATMs’ scan the customers fingers and compare the vein patterns with those stored on customers’ plastic ATM cards. If they match, the authorization is verified. Last year legislation made banks responsible for withdrawals using forged or stolen ATM cards, so 20,000 out of Japan’s 110,000 ATMs now feature vein-scanning technology. This has proven more reliable than other identity-verification techniques – including fingerprint verification and iris-reading – so we’ll probably see the widespread adoption of such technologies in other countries fairly soon.

Ref: Business Week (US) 6 February 2007, ‘Biometrics: Vein Scanners Show Promise’, K. Hall. www.businessweek.com Moneycontrol.com (India) 12 May 2007, ‘Future ATMs will do a lot more than just dispense cash’, www.moneycontrol.com

Search words: ATM’s, identity theft, ID theft, security, authentification

Source integrity: ****

Latest money innovations

Typical. You wait for months for something interesting to happen and then a whole bunch of ideas arrive at once. According to an Online Banking Report, the market for peer-2-peer lending could exceed 100,000 loans or US $1 billion by 2011 so it’s not surprising that peer-to-peer money lending websites are popping up like daisies across North America and Europe. In the Netherlands Boober is a P2P money exchange, while in Germany the local version is called Smava. Over in Canada, Community Lend is due to launch a similar idea in autumn. Meanwhile, Allow Card has been launched in the US – a teen friendly debit card backed by Mastercard that is also a ‘financial training program’ for minors. The card is essentially a pre-paid spending card that allows parents to set spending limits and features 35 other controls including the ability to view spending history, and disable individual merchant codes, card access and ATM use. For teens (and tweens) the card also features online tools and lessons to teach fiscal responsibility.

Ref: Springwise (Neth) 26 March 2007, ‘Bankless Banking’. www.springwise.com

Trend Central (US) 26 February 2007, Tween-friendly debit programs. www.trendcentral.com See also www.bbber.nl, www.smava.de. www.communitylend.com www.allowcard.com

Search words: Peer-to-peer lending, P2P lending, online banking, teens, tweens, cards

Source integrity: ***

The low, low cost of capital

Interest rates are sneaking up but borrowers around the world are generally pretty happy. Moreover, according to the people that know about these things, the low cost of debt is likely to continue for the next 5 to 7 years and possibly the next 10 to 20 years.This is good news because companies are making large capital investments again. Meanwhile private equity firms are using cheap borrowed money to buy supposedly inefficient firms at staggering prices, while some homeowners are sitting on the top of a booming real estate market. But it’s not all good news. According to some observers, cheap and easy money is laying the foundations for future problems. For example, now that debt is so cheap there is little financial incentive for companies (or households) to be fiscally sound. Current problems can be bought off with future debt. Borrowing terms are also becoming more relaxed which add to these worries. For example, in the US, Pilgrim’s Pride Corp recently issued bonds that allowed it to purchase another chicken processor in Japan. Nothing strange about that apart from the fact that the financial benchmarks for raising money were not historical financial results but future projections. The problem here and elsewhere, of course, is that there is now so much liquidity flowing around the newly flat and connected world that investors have lowered their standards. But what happens if the cost of money unexpectedly starts to rise?

Ref: Business Week (US) 19 February 2007, ‘It’s a Low, Low, Low-Rate World’, M.Mandel, D. Henry. www.businessweek.com

See also The Economist (UK) 10 March 2007, ‘Economic Focus: Anatomy of a hump'

Search words: Loans, lending, liquidity, finance, borrowing, debt

Source integrity: ****

The Future of Banking is Older People

According to HSBC, individuals aged over 55 years of age hold about 70% of global wealth (about US$63 trillion). Meanwhile, McKinsey estimates that people that are 5 to 10 years from retirement hold around one third of the personal financial assets in the US. Not surprisingly, the banks know this and they also know that any market where insecurity meets money is full of opportunity. As a result banks like Well Fargo and Citigroup are setting up specialist services aimed at seniors with cash to spend or invest. For example, Wells Fargo has established an Elder Services Group targeting people aged over 55 years of age with more than US$1 million to invest. In return for fees starting at 2% of funds under management, the bank offers customers services ranging from picking up pills and dry cleaning to selecting nursing homes. At the slightly wealthier end of the market, Citigroup is targeting ageing baby boomers with assets of at least US$ 5 million to spend or invest. There is also an enormous market for advising people on financial planning and especially what to do with their largest financial asset – their home. Unfortunately banks are not always the most trusted of advisors so banks like HSBC are implementing new ideas such as hiring older salespeople to deal with older customers in an attempt to redress the balance.

Ref: The Economist (UK) 14 April 2007, ‘Retirement and banks: From cheque books to checking pulses’. www.economist.com

Search words: Ageing, boomers, pensions, super, investment, retirement

Source integrity: *****

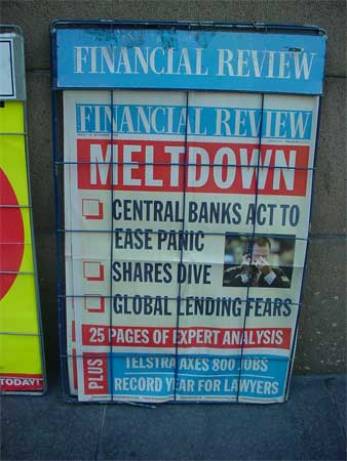

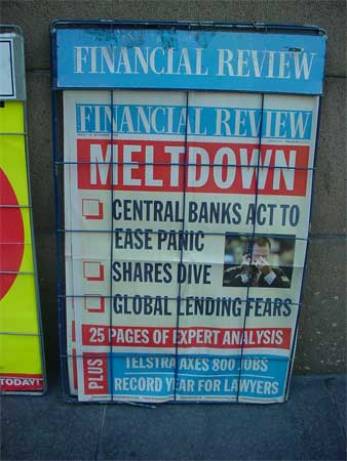

Sub-Prime Lending Trends

You know there is trouble ahead when you can buy a book called ‘House Flipping for Dummies’ (‘Flipping’ being the colloquial term for ‘doing up’ a property quickly, in order to sell it on). In the US such a book does exist and so too does the sub-prime borrowing market, which is a nice way of talking about lending money to people with tarnished credit histories or dubious income. In the UK the sub-prime market is tastefully referred to as ‘non-conforming’ or ‘adverse credit’ lending. Whatever the name, the sub-prime mortgage market is in trouble. In the US, sub-prime loans make up around 20% of all mortgage lending but late payments rose to 12.6% at the end of 2006 – up from around 7% at the end of 2003. Meanwhile, in the UK, sub-prime lending makes up around 10% of all home loans, up from around 6% in 2005 and bad debt and late payment is similarly increasing. For example, HSBC, the biggest bank in Europe, says its bad-debt costs increased by 36% to over US $10 billion last year. Why is this happening? The main reason is that banks and other lenders are lending to people they shouldn’t or are disguising risk. For example, many lenders offer ‘interest-only’ loans that are nothing of the sort, or they offer ‘hybrid’ loans with very low initial interest rates that balloon after a few months. Borrowers are ‘shocked’ about the amount of money that they need to find each month. For instance, 75% of sub-prime loans issued in the US between 2004 and 2005 were hybrid loans that will see higher interest rates apply in 2007. There may be trouble ahead but nobody is quite sure at this stage how far the trouble will spread.

Ref: The Economist (UK) 10 March 2007, ‘Subprime lending rising damp’. Also see The Economist (UK) 24 March 2007, ‘Sub-prime mortgages: When the tide goes out’

Search words: sub-prime lending, loans, mortgages, risk, credit, debt.

Source integrity: *****